Your cart is currently empty!

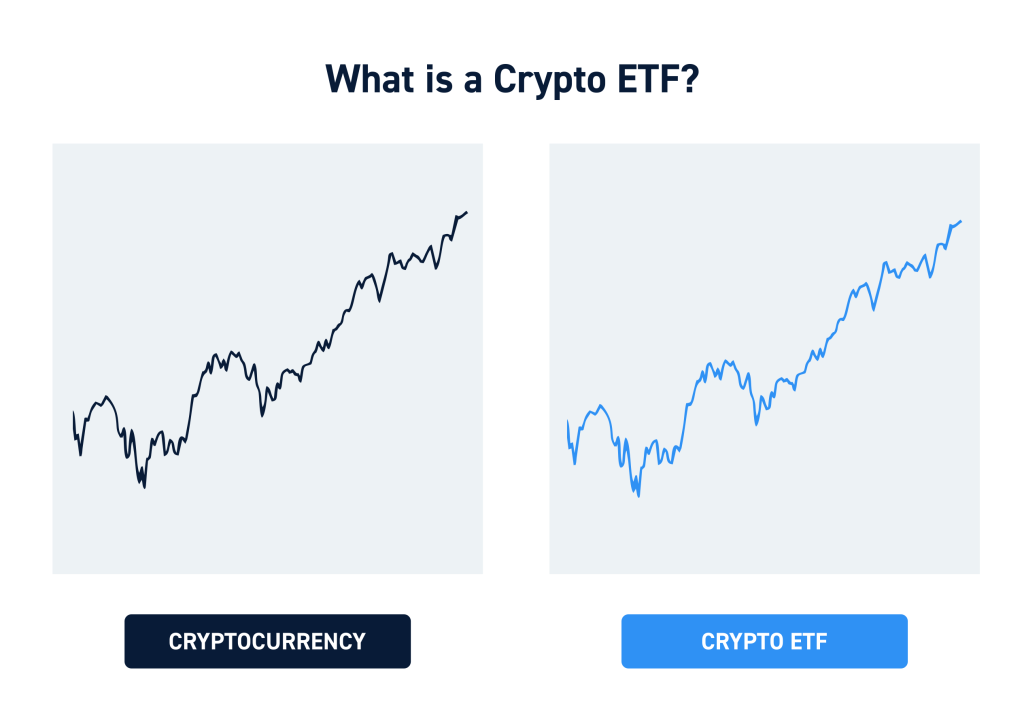

Crypto ETFs, or cryptocurrency exchange-traded funds, are rapidly gaining traction as a preferred investment option among traders and investors alike. In the evolving landscape of digital assets, these funds offer a seamless way to gain exposure to cryptocurrencies without the hassle of managing the assets directly. By tracking the price movements of prominent cryptocurrencies like Bitcoin and Ethereum, crypto ETFs are making crypto investments more accessible for anyone looking to diversify their portfolios. With the recent surge in institutional interest and the growing acceptance of blockchain technology, it’s no wonder that cryptocurrency ETFs are at the forefront of modern investment strategies. As an easy entry point into the world of digital currencies, these funds are redefining how investors perceive and interact with the cryptocurrency market.

In the dynamic universe of digital finance, alternative investment vehicles such as cryptocurrency exchange-traded funds (ETFs) are transforming how investors engage with blockchain technology. These innovative financial instruments allow individuals to gain indirect exposure to the world of cryptocurrencies, streamlining the process of asset acquisition without the complications often associated with direct ownership. As the popularity of assets like Bitcoin continues to rise, Bitcoin ETFs are becoming increasingly significant tools for portfolio diversification. Moreover, as regulatory bodies begin to approve these funds, more individuals and institutions are exploring ways to leverage digital assets through tailored investment strategies. Ultimately, the advent of cryptocurrency ETFs signals a new era for both novice and seasoned investors looking to capitalize on the potential of digital currencies.

The Rise of Cryptocurrency ETFs in Modern Investment Strategies

In the evolving landscape of finance, the rise of cryptocurrency ETFs has marked a significant shift in modern investment strategies. Investors are increasingly looking for opportunities that blend traditional asset management principles with the dynamic nature of digital assets. By offering a pathway to invest in cryptocurrencies without the complexities of direct trading, crypto ETFs cater to a broader audience, including those who may be hesitant to buy and hold Bitcoin or Ethereum directly. The appeal lies not just in accessibility, but also in the growing regulatory framework that provides a level of security often sought by traditional investors.

As institutional interest skyrockets, the strategic integration of cryptocurrency ETFs into investment portfolios represents a response to both market demand and the evolving nature of risk management. With the ability to diversify within a single fund, investors can hedge against volatility while embracing the growth potential of cryptocurrencies. The blend of risk and opportunity encapsulated within crypto ETFs embodies the innovative spirit of the investing landscape, making them a key component in the strategy toolbox for both novice and seasoned investors.

Understanding the Benefits and Risks of Crypto ETFs

Investors considering cryptocurrency ETFs must weigh the myriad benefits they offer against the inherent risks associated with digital assets. One of the main advantages is the enhanced liquidity provided by trading on traditional stock exchanges, which facilitates quicker entry and exit from positions, especially during market fluctuations. Moreover, for those unfamiliar with the intricacies of crypto trading platforms, ETFs simplify the investment process significantly. They allow for exposure to cryptocurrencies without needing to manage wallets or navigate the often complex world of crypto exchanges, making them an appealing option for many.

However, potential investors should also recognize the risks tied to cryptocurrency ETFs, primarily concerning fees and limited control. The management costs associated with these funds can be steeper than those of traditional investments, eating into potential returns. Additionally, investors in crypto ETFs forgo the benefits of direct ownership, such as participating in governance decisions for underlying assets. Understanding these trade-offs is crucial for those looking to integrate crypto ETFs into their broader investment strategies, ensuring that they align with both financial goals and risk tolerance.

Frequently Asked Questions

What are the key advantages of investing in cryptocurrency ETFs?

Investing in cryptocurrency ETFs offers several advantages, including enhanced accessibility to digital assets, regulatory oversight that provides a sense of security, and greater liquidity during trading. Unlike direct crypto investments, crypto ETFs allow traditional investors to easily enter the market without needing to manage wallets or exchanges. Furthermore, their structure simplifies the process of diversification, making them a compelling choice for those interested in cryptocurrency investments.

How do Bitcoin ETFs impact the cryptocurrency market?

Bitcoin ETFs have a substantial impact on the cryptocurrency market by facilitating institutional investments and legitimizing digital assets as investment vehicles. The recent approvals of Bitcoin ETFs have led to increased demand, which often correlates with price surges in Bitcoin. These products enhance market liquidity and introduce more investors to the crypto space, potentially stabilizing prices and reducing volatility over time.

| Key Point | Details |

|---|---|

| Definition of Crypto ETFs | Funds traded on stock exchanges that allow investors to gain exposure to cryptocurrencies without direct ownership. |

| Popularity Surge | Significant increase in institutional interest and product offerings post-2023, indicating a normalization of crypto investments. |

| Approval of Bitcoin ETFs | Recent approvals of Bitcoin ETFs by U.S. regulators mark a critical step towards institutional adoption, directly impacting Bitcoin’s market performance. |

| Market Performance | Bitcoin’s price surged following ETF approvals, reflecting renewed optimism despite high volatility risks in the sector. |

| Investor Interest | Growing trend among institutional investors to include crypto ETFs in portfolios due to diversification and inflation hedging potential. |

| Pros of Crypto ETFs | Accessibility, regulatory oversight, and enhanced liquidity make crypto ETFs appealing to traditional investors. |

| Cons of Crypto ETFs | Higher management fees and limited control over investment choices compared to direct cryptocurrency ownership. |

Summary

Crypto ETFs are redefining how investors engage with the dynamic world of cryptocurrency. By offering a pathway that combines the benefits of regulated investment and the lucrative possibilities of digital currencies, they have captured substantial interest from both individual and institutional investors alike. The recent approval of Bitcoin ETFs signifies a turning point, reinforcing the notion that cryptocurrencies are not just a passing trend but a staple in the investment landscape. As the market continues to evolve, crypto ETFs present a valuable opportunity, allowing investors to navigate this new territory with greater confidence and reduced complexity.

0 responses to “Crypto ETFs: Everything You Need to Know About Them”